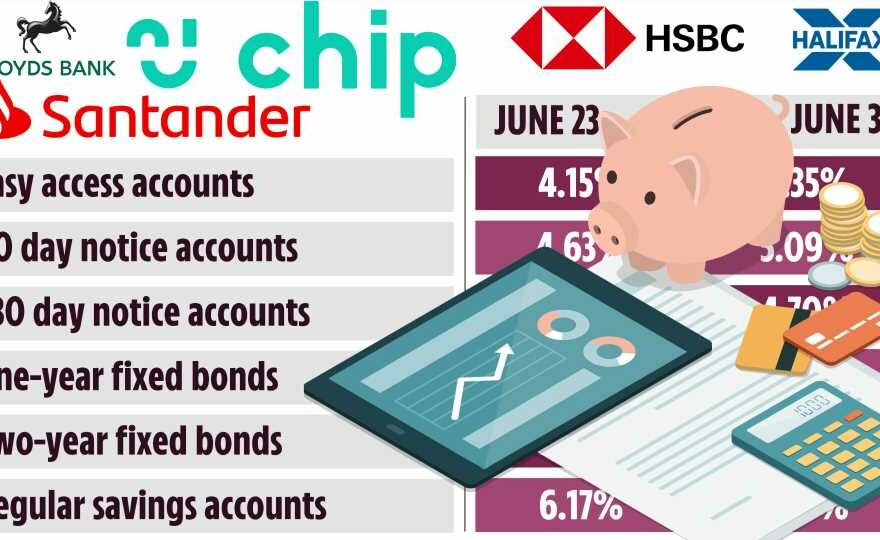

BANKS and building societies are finally increasing savings rates after being blasted for punishing borrowers and failing to reward savers.

It comes after Martin Lewis slammed banks and building societies for failing to pass on higher interest rates to their customers.

The Bank of England raised the base rate from 4.5% in May to 5% in June, but savers have been lucky to get rates that match this level in recent weeks.

Speaking on ITV’s Good Morning Britain, last week he said: "They’re putting borrowing up, but they're not putting savings up by the same amount.

"That seems absolutely outrageous to me, because when the banks were struggling in 2007/2008, we, the state, the taxpayer, bailed them out.

"We, the state, the taxpayer are struggling right now.

Read more in money

Martin Lewis warns of ‘nightmare’ year for renters and homeowners

Major change to energy bills coming within HOURS – what you need to do now

"They should be doing what they can in return, because they’re too big to fail and, now, they don’t want us to fail.

"They should be doing what they can in return."

However, a handful of high street banks and little-known challenger banks have upped their savings rates this week and we've listed them below.

Chip

Last week, Chip's easy access savings account offered customers 4% back in interest and unlimited cash withdrawals as long as they saved £1.

Most read in Money

Major mobile networks down leaving customers unable to make or receive calls

We've been ordered to tear down our £20k shed after ONE busybody moaned

Second largest bakery chain closes nine shops – is your local impacted

Exact date Brits should get £150 Cost of Living payment revealed – how to claim

But the platform has raised interest rates by 21 basis points to 4.21% this week.

This means that those saving £1,000 in the account could now expect to gain £42.10 in interest after 12 months.

Halifax

Rates on a one-year fixed saver account with Halifax have increased by 50 basis points from 4.3% to 4.8% last week.

And the interest rates on a two-year fixed account have risen from 4.35% to 4.85%.

The bank also upped the rates offered on the Reward Bonus Saver account from 3% to 3.4%.

HSBC

HSBC's Online Bonus Saver used to pay customers 3.5% back on savings between £1 and £10,000.

But HSBC has recently upped the amounts of interest paid and savings that can earn 4% in its Online Bonus Saver.

Those saving between £1 and £50,000 can now get 4% back.

Leeds Building Society

Leads Building Society has boosted the rate offered on its Rainy Day Account.

This pays savers 4.35% back on any deposits between £1 and £5,000 and allows for two withdrawals per year.

This means that those saving £1,000 in the account could now expect to gain £43.50 in interest after 12 months.

Lloyds Bank

Lloyds Bank has increased rates for fixed-rate savings accounts in recent days.

Rates on a one-year fixed bond have increased by 50 basis points to 4.95%.

And rates on a two-year fixed bond have gone up by 45 basis points to 5%.

Santander

Santander has boosted all savings accounts linked to the BoE base rate and will see their interest increase by 0.5% from July 3.

These include the Rate for Life and Good for Life savings accounts.

The bank says it is reviewing its other products and will contact customers if it makes any changes.

How can I find the best savings rates?

With your current rates in mind, don't waste time looking at individual banking sites to compare rates – it'll take you an eternity.

Research websites like MoneyFacts and price comparison websites such as Compare the Market, Go Compare and MoneySupermarket will help save you time and show you the best rates available.

These sites let you tailor your searches to an account type that suits you.

Read More On The Sun

Three trendy accessories that make women look cheap in an instant

Millions of iPhone users told to turn key feature off – ignoring it may cost you

There are five main types of savings accounts, and understanding the differences can help you narrow down the options.

- Easy-access savings accounts – usually allow unlimited cash withdrawals. However, this perk means they tend to come with lower interest returns.

- Regular savings accounts – generate decent returns but only on the basis that you pay in a set amount each month.

- Notice accounts – offer slightly higher rates than easy-access accounts but you'll need to give advance notice to your bank (up to 95 days) before you can make a withdrawal or you'll forfeit the interest.

- Fixed-rate bonds – these offer some of the highest interest rates. However, if interest rates increase during your term you can't move your money and switch to a better account.

- Individual savings accounts (ISAs) – these can pay high interest but come with high withdrawal fees. But, Lifetime Isas are great for anyone aged 18-39 hoping to buy a house or save for retirement.

Source: Read Full Article