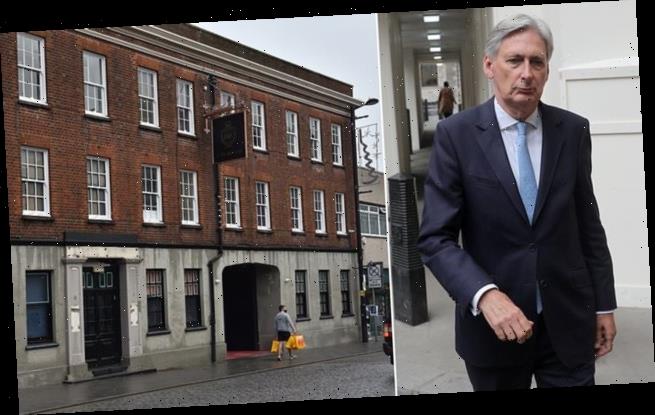

ANNA MIKHAILOVA: Spreadsheet Phil…the nightclub king of Essex! Former Chancellor Hammond is financial backer behind TOWIE’s Sugar Hut

The former Chancellor is a financial backer behind the Sugar Hut, a kitschy nightclub in his home town of Brentwood

Philip Hammond has vajazzled his gloomster image, I can reveal.

The former Chancellor is a financial backer behind the Sugar Hut, a kitschy nightclub in his home town of Brentwood that shot to fame through ITV reality show The Only Way Is Essex.

Hammond was ‘delighted’ to join other grandees on the advisory board of OakNorth Bank, a British fintech lender to small and medium-sized businesses struggling to access substantial credit.

One was Essex-based Stondon Capital Limited. Records show the firm then loaned money to a Lithuanian woman to buy the Sugar Hut from Mick Norcross, the Towie star found dead at his home in January, aged 57.

This is not Lord Hammond’s first foray into the Towie-land night-time economy.

As sixth-former at Shenfield School, the entrepreneurial Essex Boy ran the Phoenix Mobile Disco at The Hermitage, where, in 1972, people danced, snogged and posed to the sound of glam rock amid plumes of marijuana smoke.

‘He looked like a nerd,’ reminisced a fellow raver, recalling Hammond’s long hair, John Lennon specs and full-length black leather coat.

‘But he was ‘the man’. He had a car, a driver and the whole thing going for him at the age of 18.’

Back then, Phil could be spotted being chauffeured around town in his Ford Granada with a bevy of back-seat beauties.

‘All these good-looking girls gravitated to him – money, cars and cash – it looked pretty slick.’

Who knew Spreadsheet Phil was such a diamante geezer?

The Sugar Hut is pictured above. Hammond was ‘delighted’ to join other grandees on the advisory board of OakNorth Bank, a British fintech lender to small and medium-sized businesses struggling to access substantial credit

Speaker’s fighting talk…

Pugnacious former Commons Speaker John Bercow is to join boxing manager Frank Warren’s stable, as non-executive director of Queensberry Promotions.

The two men are long-time buddies and the Islington-born Warren often gifted the then MP tickets to watch his beloved Arsenal football team.

Bercow hopes to help his friend’s company deliver ‘strategic objectives’.

And none is bigger than signing a £200 million two-fight deal between British heavyweights Tyson Fury, in Warren’s corner, and Anthony Joshua, for the undisputed world title.

We look forward to a ringside photo of Bercow sitting between Warren and Fury’s adviser, Daniel Kinahan, an international figure in boxing (and reputed Irish crime boss).

Three months since her appointment as the PM’s spokesman and Allegra Stratton is still absent from No 10 TV briefings despite more than £2.6 million spent refurbing a Downing Street press room. Even with no launch date, it’s not all been a waste of taxpayers’ cash. I’m told that plumbers have finally plugged a leak problem at No 9. Hopefully, for us Westminster reporters, the one next door will continue.

One MP enjoying a pandemic-proof pay cheque is Bill Wiggin.

The 54-year-old received his annual bonus as managing director of Emerging Asset Management (EAM), a Bermuda-based company that helps hedge funds set up in offshore tax havens.

Wiggin’s £3,195 bonus for July to December is on top of his EAM salary of £49,000 and separate from the £81,932 he receives from taxpayers for representing his North Herefordshire constituency.

Last month, the Tory MP proudly announced in a Bermudan newspaper that EAM had reached the significant milestone of having $1 billion (£721 million) worth of funds under management.

Here are some other headline figures from EAM’s latest accounts: annual earnings, $1.4 million; tax paid, $7,500. Meanwhile, the number of occasions Wiggin spoke in the Commons chamber during his EAM six-month bonus period: eight.

Source: Read Full Article