MILLIONS of households will be hit with a raft of bill hikes this week, but there are ways to avoid them.

From broadband and energy to council tax, families could be forking out hundreds of pounds extra each year unless they act now.

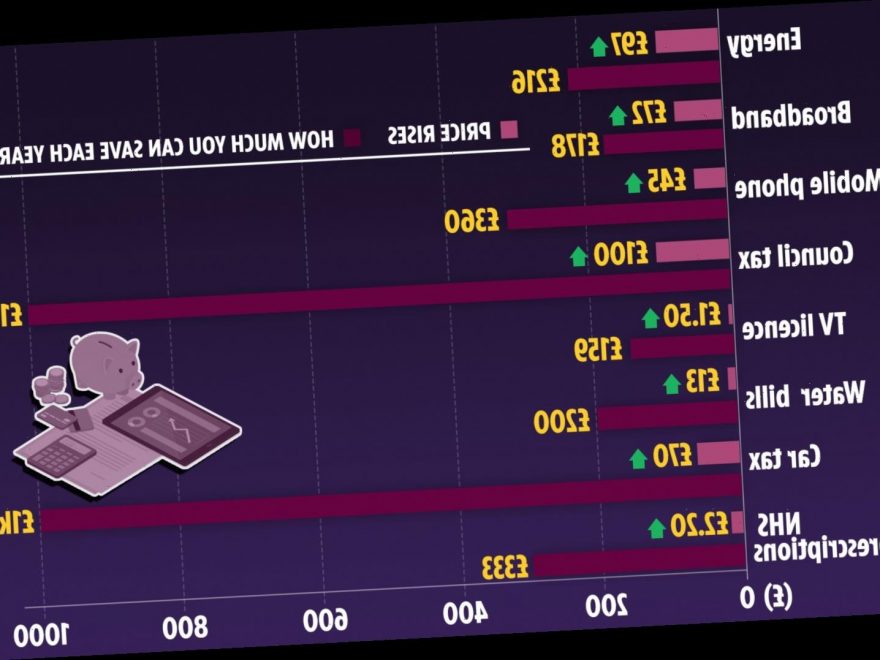

In fact, comparison site Money.co.uk estimates the average cost of living is set to rise by £206 per household from April 1.

The changes come as plenty of providers hike prices at the start of the new financial year.

The current tax year, which started on April 6, 2020, is set to end on April 5.

By being savvy with your cash, it's possible to beat the hikes. Below we explain how.

Energy – increasing by £97 a year

Energy bills are set to rise by up to £97 a year for many households from April 1 due to an increase in the price cap.

It comes as regulator Ofgem has upped the maximum price suppliers can charge for electricity and gas from £1,042 a year to £1,138.

The cap affects around 11million households on standard variable tariffs.

Around 4million households on prepayment meters will also see bills rise by £87, to £1,156.

How to save on your energy bills

SWITCHING energy providers can sound like a hassle – but fortunately it’s pretty straight forward to change supplier – and save lots of cash

Shop around – If you're on an SVT deal you are likely throwing away hundreds of pounds a year. Use a comparion site such as MoneySuperMarket, uSwitch or EnergyHelpline.com to see what deals are available to you.

The cheapest deals are usually found online and are fixed deals – meaning you'll pay a fixed amount usually for 12 months.

Switch – When you've found one, all you have to do is contact the new supplier.

It helps to have the following information – which you can find on your bill – to hand to give the new supplier.

- Your postcode

- Name of your existing supplier

- Name of your existing deal and how much you pay

- An up-to-date meter reading

It will then notify your current supplier and begin the switch.

It should take no longer than three weeks to complete the switch and your supply won't be interrupted in that time.

Following the price cap change, British Gas has announced a bill hike of up to £97.

While Scottish Gas, EDF Energy, EOn, NPower and SSE are increasing prices too by £96.

But you could save £216 a year on average, according to Uswitch, by switching energy supplier for both gas and electricity.

You can check how much you can save by using the price comparison checker on its website.

Broadband – rise of £72 a year

Some of the largest broadband providers are putting up their prices at the start of April.

Sky is upping bills by up to £72 per year for some customers, depending on what type of products you have.

Meanwhile, Virgin Media is hiking prices by £44 per year for some households, and BT prices are going up by £24.

But you could slash your bill by hundreds if you switch to another provider, according to Uswitch.

The average yearly saving for customers who switch broadband providers is £177.57 – but this figure could be even more depending on where you live.

Before you switch, check if you’re still in contract and if you need to pay any exit fees.

You should also take into account how fast of a connection you need, and if you can cut back costs by going for a slightly slower speed.

Mobile phone – hike of £45 a year

If you’re a Three Mobile, Vodafone or EE customer, you might see your bill jump this week too.

Vodafone will hike prices by up to £45 from April for customers who signed up or renewed their mobile contract from December 9, 2020.

Three will also raise prices by 4.5% from April, which affects customers who took out a new deal or renewed their contract after October 29, 2020.

Plus, BT-owned EE is upping prices by £24 per year for those who took out a deal between September 1 2020 or before January 11 2019.

How to save on your mobile phone bill

NOT happy with your current mobile phone deal?

If you’re outside the minimum term of your contract then you won't need to pay a cancellation fee – and you might be able to find a cheaper deal elsewhere.

But don't just switch contracts because the price is cheaper than what you're currently paying.

Take a look at how many minutes and texts, as well as how much data you're using, to find out which deal is best for you.

For example, if you're a heavy internet user it's worth finding a deal that accomodates this so you don't end up spending extra on bundles or add-ons each month.

Also note that if you're still in your contract period, you might be charged an exit fee.

Ready to look elsewhere? Pay-as-you-go deals are better for people who don’t regularly use their phone, while monthly contracts usually work out cheaper for those who do.

It's worth using comparison websites, such as MoneySupermarket and uSwitch.com, to compare tarrifs and phone prices.

Billmonitor also matches buyers to the best pay-monthly deal based on their previous three months of bills.

It only works if you’re a customer of EE, O2, Three, Vodafone or Tesco Mobile and you’ll need to log in with your online account details.

There's also MobilePhoneChecker,which has a bill monitoring feature that recommends a tariff based on your monthly usage.

If you’re happy with your provider then it might be worth using your research to haggle a better deal.

Customers locked into a fixed deal won't be able to dodge the price hikes, because the price rises were outlined in the terms and conditions.

You could still cash by switching deals, but you may face being slapped with a penalty fee for leaving your contract early.

Of course, this will eat into any savings you may make elsewhere.

Meanwhile, bill payers who are out of contract can switch deals penalty-free, and it could save you up to £360 a year.

You can check out the cheapest deals using Uswitch’s mobile phone bill comparison checker.

But make sure you pick a package that is right for you, rather than just the cheapest.

You should take into consideration how many minutes, data and texts you currently use, otherwise you could end up forking out extra for expensive add-ons.

For example, if you're a heavy internet user it's worth finding a deal that accommodates this, or if you make lots of calls, find the best price for a package with lots of minutes.

Council tax – £100s extra a year

Households could see their council tax bills jump by up to 5% in April – adding £100 more to their bill.

The Treasury gave the green light for the tax hike in last year’s spending review, with the extra cash raised earmarked to pay for rising police and social care costs.

Over half of households are in for the maximum council tax rise, according to research from the Local Government Chronicle.

But you could cut your council tax bill by thousands of pounds, if you're in the wrong band and successfully challenge it.

A pensioner recently won back £3,500 in council tax overpayments for his daughter and her elderly neighbour using a simple online form.

If you're in the right band, you may still be eligible for a council tax discount. We explain all you need to know in our guide.

TV licence – £1.50 extra a year

The TV licence fee is set to rise from £157.50 to £159 from April 1.

The cost of an annual black and white licence will also rise from £53 to £53.50.

Telly watchers legally have to pay the annual fee whether they're watching live TV or on BBC iPlayer on any device.

But there are ways to watch TV for free legally without having a TV licence.

For example you can watch catch-up TV and on demand previews through services including ITV Player, All 4, My5, BT Vision/BT TV, Virgin Media, Sky Go, Now TV, Apple TV, Chromecast, Roku and Amazon Fire TV.

You can also watch video clips that aren't live through YouTube.

You might also be eligible for a free TV licence if you claim pension credit.

Water – increasing by £13 a year

Water bills across England and Wales are set to drop from £410 to £408 this year on average – saving you £2.

But some providers will increase their prices.

For example, Welsh households who get their water from Hafren Dyfrdwy will see their bills rise by 5% this year, meaning the average household will be forking out £13 extra.

But you could beat the hike by switching to a water meter.

According to the Consumer Council for Water (CCW), customers save an average of around £200 by switching to a water meter.

However, not everyone will save, but you’re more likely to if you’ve got more bedrooms than people living in your home.

Some customers have saved up to £400 a year, CCW says.

You can calculate how much you might save by using CCW’s water meter calculator.

If you're struggling to pay, we explain how to get help with your water bills.

Car tax – up by £70 a year

Vehicle Excise Duty (VED), known more commonly as car tax, is rising from April 1.

What you pay depends on how much CO2 your car pumps out.

If your car was registered on or after April 1 2017, you will have to pay the following for the first 12 months:

- You won’t have to pay anything if your car emits no CO2

- £10 if your car emits 1-50 grams per kilometre of CO2 (the same tax rate as last year).

- £25 if your car emits 51-75 grams per kilometre of CO2 (the same tax rate as last year

- £115 if your car emits 76-90 grams per kilometre of CO2 (£5 extra than last year)

- £140 if your car emits 91-100 grams per kilometre of CO2 (£5 extra than last year)

There are 13 pay brackets in total, and the highest you’ll be paying is £2,245 if your vehicle emits over 255g per kilometre of CO2, marking an increase of £70 since last year.

However, if you're disabled, you may be eligible for an up to 100% reduction in car tax – meaning you can save thousands of pounds a year.

If you have a used vehicle, you need to go to a Post Office branch that deals with vehicle tax. You can find out more on the Gov.uk website.

NHS prescriptions – up to £2.20 hike

Prescription items are currently £9.15, but will go up to £9.35 in England from April 1.

The price of a three-month prescription will also rise to £30.25 (up by 60p) and a 12-month prescription will be £108.10 (a hike of £2.20).

But you can save money on medicines if you apply for a prescription prepayment certificate.

The most you can save is to £330.30 a year if you have four items under your prescription.

You can save £223.50 with three items a month, and £113.70 with two.

Wales, Scotland and Northern Ireland don't have charges on prescriptions.

We round up 19 new laws and financial changes coming into force in April.

We've also rounded up 16 tips to slash your supermarket shopping bill by hundreds of pounds a year.

And here are eight Martin Lewis money-saving tips that could save you £9,243.

Source: Read Full Article